Funding Your App Development: Bootstrapping vs. Seeking Investors

Launching a successful app requires more than just a brilliant idea and technical expertise; it demands a solid financial strategy. Choosing the right funding approach is crucial, as it influences your control over the business, growth trajectory, and long-term sustainability.

Although there are many options available to finance your startup primary methods stand out: bootstrapping and venture capital funding. Each approach has distinct advantages and challenges, making the decision highly dependent on your startup’s goals, financial resources, and risk tolerance.

Understanding the nuances of both funding models and using a structured evaluation method can help you make an informed decision. In this guide, we’ll explore the pros and cons of bootstrapping and venture-backed funding, and how to determine which path aligns with your app development goals.

Bootstrapped Approach

Definition

Bootstrapping refers to funding your startup using personal savings, revenue from early sales, or reinvested profits instead of relying on external investors. This method demands financial discipline and strategic growth but allows founders to maintain complete control over their business.

Benefits

- Full Ownership and Control – You retain decision-making power without investor interference.

- Financial Discipline – Operating with limited resources encourages efficiency and prioritization.

- Sustainable Growth – Growth is steady and organic, reducing the pressure of rapid scaling.

- Avoiding Dilution – You don’t have to give away equity, ensuring future profits belong entirely to you.

- Attractive for Future Investment – A bootstrapped startup with a strong track record may later attract investors on favorable terms.

Challenges

- Limited Resources – Without external capital, scaling can be slow and operational budgets tight.

- Higher Personal Financial Risk – Founders may need to invest their own savings or take on personal debt.

- Difficult to Compete in Fast-Paced Markets – Industries with rapid innovation cycles may require substantial funding to stay competitive.

- Harder to Attract Top Talent – Without deep pockets, hiring skilled developers and marketers can be challenging.

Venture Capital Approach

Definition

Venture capital (VC) funding involves raising capital from investors in exchange for equity. VCs provide financial backing to startups with high growth potential, typically in exchange for a stake in the company and some level of control over business decisions.

Benefits

- Access to Large Capital Pools – Enables rapid scaling, marketing expansion, and product development.

- Industry Expertise and Network – VCs often provide strategic guidance and valuable connections.

- Lower Personal Financial Risk – Unlike bootstrapping, you’re not using personal savings or taking on debt.

- Faster Growth Potential – Capital injection allows startups to scale aggressively and capture market share quickly.

- Attractive for High-Stakes Markets – Ideal for industries that demand heavy R&D investments and quick scaling.

Challenges

- Loss of Control – Investors often require a say in key business decisions.

- Equity Dilution – Founders must give up a portion of ownership, reducing future earnings from the company.

- High Pressure for Growth – VC-backed startups are expected to scale rapidly, sometimes leading to unsustainable expansion.

- Exit Expectations – Investors typically seek high returns, pushing for acquisitions or IPOs, which may not align with your long-term vision.

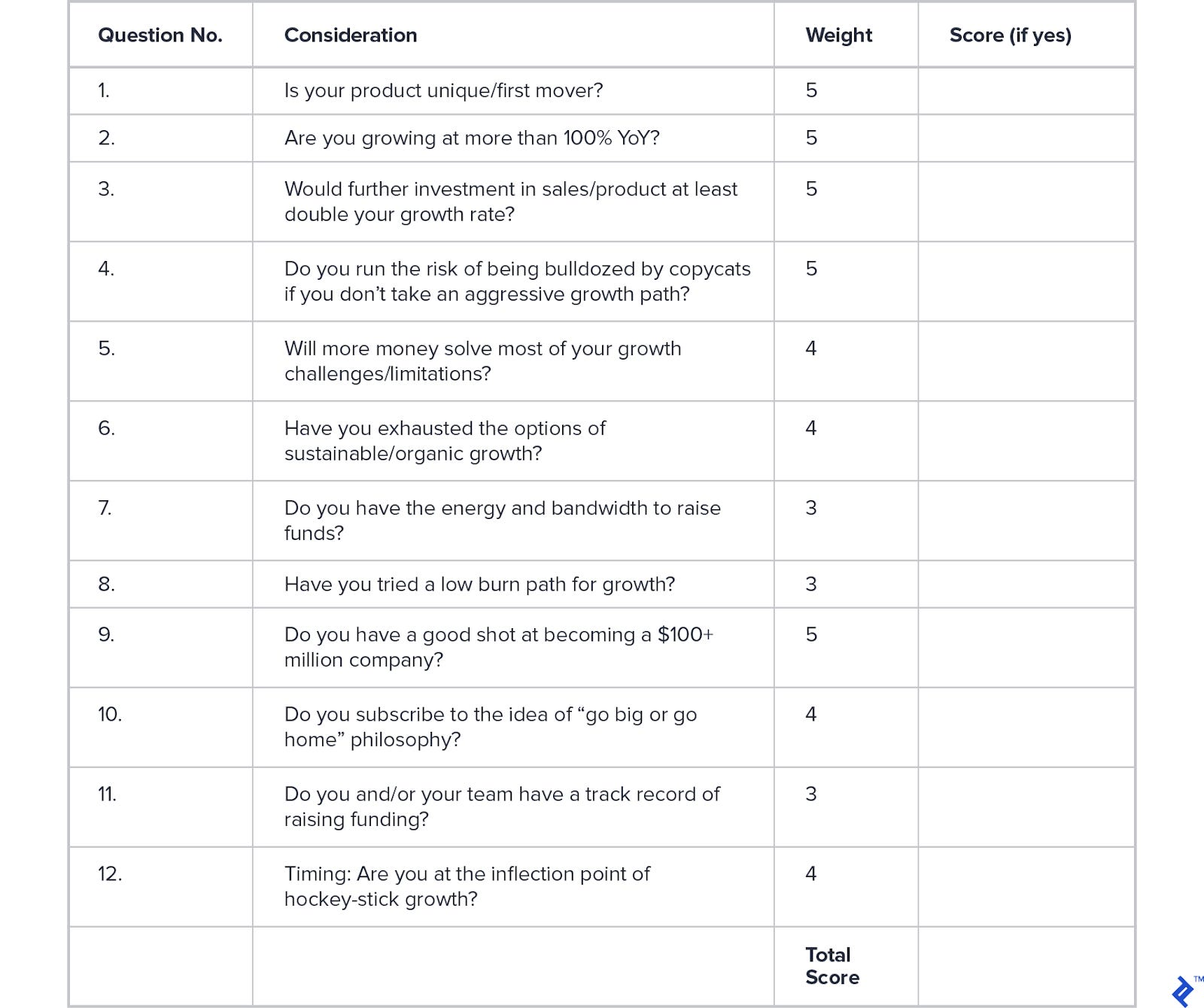

How to Decide Between Bootstrapping vs. Venture Capital

Choosing between bootstrapping and VC funding isn’t a one-size-fits-all decision. It depends on various factors such as financial resources, risk tolerance, and market competitiveness. A scorecard approach can help evaluate which funding route better suits your startup.

Key aspects to consider:

- Growth Timeline – How quickly do you need to scale?

- Financial Resources – Do you have enough savings or early revenue to sustain operations?

- Control Preferences – How much autonomy do you want over business decisions?

- Industry Competition – Is your market fast-moving, requiring substantial investment to compete?

- Revenue Model – Does your app generate revenue early, or does it need significant upfront capital?

- Risk Tolerance – Can you afford to take financial risks without external backing?

For a detailed breakdown, refer to Toptal’s funding scorecard.

How to Decide Based on Score

Once you’ve assessed your startup based on the key factors, use the scorecard to determine the ideal funding approach:

- Score below 30 – Bootstrapping is likely the best option. Your business model may support organic growth without external funding.

- Score above 40 – External funding might be necessary to achieve your growth objectives and remain competitive.

- Score between 30-40 – A balanced approach is required. Consider hybrid models like initial bootstrapping followed by strategic funding rounds.

Exploring Other Funding Options

While bootstrapping and venture capital are two of the most discussed funding methods, they are not the only ones. Other financing avenues can also support your app development journey:

- Angel Investors – Wealthy individuals who provide capital in exchange for equity or convertible debt, often offering mentorship alongside funding.

- Crowdfunding – Raising small amounts of money from a large number of people through platforms like Kickstarter and Indiegogo.

- Strategic Partnerships – Partnering with a larger company that provides funding in exchange for technology access, product integration, or other benefits.

- Government Grants & Programs – Various government initiatives provide non-dilutive capital to support innovation and business growth.

Each of these methods has unique benefits and challenges, which we will cover in detailed upcoming posts. Stay tuned as we break down their definitions, advantages, and potential pitfalls, helping you make the best choice for your startup!

Conclusion

Funding your app development is a pivotal decision that shapes your startup’s future. Bootstrapping offers control and financial independence but comes with slower growth and higher personal financial risks. Venture capital provides rapid scaling opportunities and industry support but often demands equity and decision-making compromises.

By leveraging a structured evaluation approach, such as the scorecard method, you can align your funding strategy with your business needs and long-term aspirations. Whether you choose to bootstrap or seek investors, the key is to ensure your decision supports sustainable growth and aligns with your vision for the company’s future.